Is income protection insurance more important than serious illness cover?

We have noticed a rise in interest in income protection insurance in the past six months. We welcome this development because we have seen at first hand how having a constant stream of income above the state disability benefit can be vitally important to the welfare of a person suffering from long term condition that results in them being unable to work.

If you would like more information on this subject please complete this short form Contact form

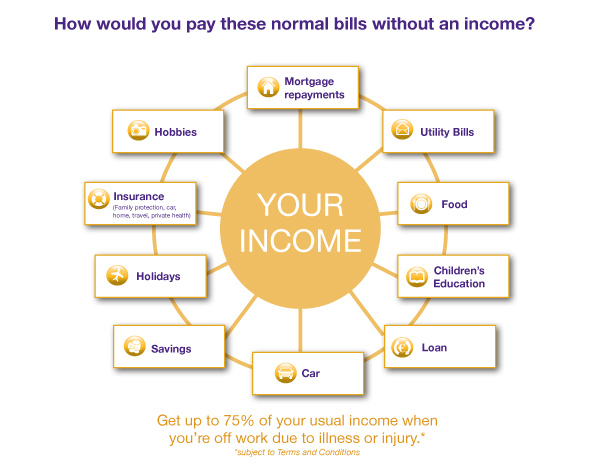

Your Income is your most important asset and it makes sense to protect it.

Every day our clients ask us about insurance cover for sickness and ill health.

There are three forms of insurance in this area:

- Medical insurance Medical insurance (often referred to as health insurance) is an insurance policy that covers medical costs which can give a policy holder access to certain hospitals and medical procedures that may not available under the public health system.The main benefit of this cover is that it may help you jump or bypass waiting lists. (Hopefully the new Government will address the waiting list issue so that all who need attention are cared for effectively and efficiently)

- Serious Illness cover. This is an insurance policy that pays out the sum insured on a policy if you contract one of the serious illnesses specified in the policy.

- Income Protection Cover. This an insurance policy that replaces up to 75% of your income, if you are unable to work due to illness or an accident.

In an ideal world you would have all three of the above. This article considers the merits of Income Protection and Serious illness cover and does not discuss the merits of medical insurance.

Let us first consider serious illness insurance.

Serious illness cover is a severe illness that has a risk of mortality and impacts on the quality of life of the person and the illness and severity level is specifically covered in the policy terms and conditions.

Typical conditions include Stroke, Cancer, Heart Attack, Multiple sclerosis.

The illness must be serious and defined in the policy. A famous high profile incident occurred when somebody contacted a radio station to complain that a life insurer would not pay out on a claim based on having restless foot syndrome.This condition was not one of the qualifying conditions in the policy!

There are a number of options available when taking out serious illness cover.

1.Mortgage related accelerated serious illness cover is a mortgage protection policy that also has serious illness element. On diagnosis of a qualifying serious illness condition, the life insurance company clears the balance on your mortgage.

2.Term life insurance policies may also have an accelerated serious illness element, whereby the cover level is paid out on diagnosis of a qualifying condition.

Accelerated serious illness may be taken out for the full level of cover in either a mortgage protection policy or a life insurance policy or, if required, at a reduced level. For example a mortgage protection policy for €250,000 over 25 years may have an accelerated illness cover to the same or a lower value.

3.Stand alone serious illness is a serious illness policy that is not linked to another policy. For example you may want to take out €50,000 serious illness cover over a term of 25 years.

Having one of these policies in the event of a serious illness is of great comfort to a claimant and his or her family. Assuming the cover level is adequate it may mean that the mortgage is paid in full or that there is a large monetary cushion available to ease the burden.

Income protection does not pay out a lump sum but instead replaces a certain percentage of your income. Income protection insurance does not require a claimant to have a serious illness in order to make a successful claim.

For self employed individuals, who may not be entitled to state illness benefit, the pay out can be up to 75% of income. For paye employees, who are entitled to state benefit, the maximum insurance level is 75% of income less €10.566 ( being the current disability allowance from the State). The claim is paid out each week and is subject to paye in the normal fashion.

Premiums are tax deductible at your marginal rate of tax. If you pay tax at 40% and the premium is €60 per month, your net cost will be €36 per month.

Quotations are subject to underwriting and the price is influenced by a range of factors including your chosen deferred period ( 4, 8, 13 , 26 or 52 weeks).This is the period when you are sick before you start claiming under the policy.

The claim is based on your ability to work and earn your income and not a specified illness.

Potentially the claim under the policy could run for many years, even up until retirement.

Some interesting facts:

Average claim period is 4 years.

46% of claims are from persons are under 50.

Over 50% of claims are orthopaedic or psychological related.

.